Home Equity Loan Conveniences: Why It's a Smart Financial Move

Home Equity Loan Conveniences: Why It's a Smart Financial Move

Blog Article

Take advantage of Your Home's Worth: The Benefits of an Equity Lending

When thinking about financial choices, leveraging your home's worth via an equity car loan can offer a critical strategy to accessing added funds. The advantages of tapping right into your home's equity can extend beyond simple ease, supplying a series of benefits that accommodate numerous financial demands. From flexibility in fund use to possible tax obligation benefits, equity car loans offer a chance worth discovering for homeowners seeking to maximize their funds. Comprehending the subtleties of equity lendings and just how they can positively impact your monetary portfolio is necessary in making educated choices for your future economic well-being.

Advantages of Equity Financings

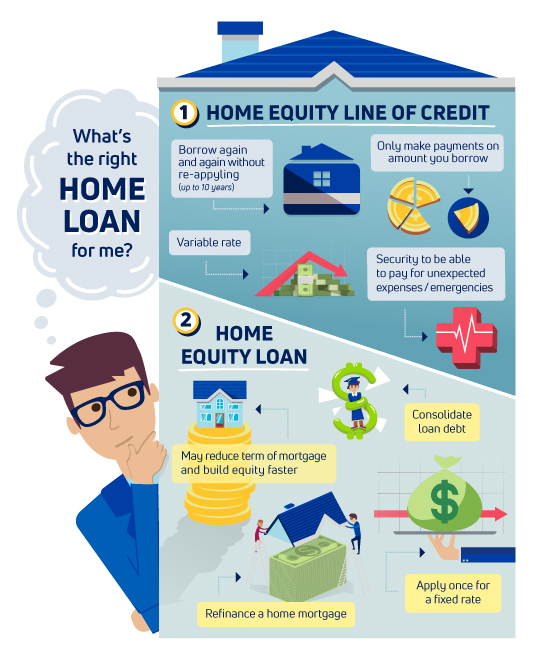

Among the primary advantages of an equity car loan is the ability to access a huge sum of cash based on the worth of your home. This can be specifically helpful for homeowners that require a substantial quantity of funds for a specific function, such as home improvements, debt loan consolidation, or major costs like medical expenses or education expenses. Unlike various other sorts of finances, an equity lending normally provides reduced passion prices because of the security provided by the building, making it an economical loaning alternative for several individuals.

Additionally, equity financings often give much more adaptability in terms of repayment routines and finance terms compared to various other kinds of funding. On the whole, the ability to access substantial sums of money at lower rate of interest prices with versatile settlement choices makes equity loans a useful economic device for homeowners seeking to utilize their home's value.

Flexibility in Fund Usage

Provided the useful loaning terms linked with equity lendings, home owners can effectively use the versatility in fund usage to meet various economic demands and objectives. Equity loans supply home owners with the freedom to utilize the borrowed funds for a large range of functions. Whether it's home restorations, financial debt loan consolidation, education and learning expenses, or unforeseen medical bills, the flexibility of equity loans enables people to resolve their monetary demands successfully.

One trick advantage of equity car loans is the lack of limitations on fund use. Unlike a few other sorts of loans that define exactly how the obtained money needs to be spent, equity loans provide customers the autonomy to allocate the funds as needed. This adaptability makes it possible for homeowners to adjust the lending to suit their unique conditions and top priorities. Whether it's buying a brand-new service endeavor, covering emergency expenditures, or funding a major purchase, equity finances empower homeowners to make strategic monetary choices lined up with their objectives.

Prospective Tax Obligation Advantages

With equity loans, home owners may gain from prospective tax obligation advantages that can assist optimize their economic preparation methods. Among the primary tax obligation advantages of an equity lending is the ability to subtract the rate of interest paid on the loan in specific scenarios. In the USA, as an example, passion on home equity car loans up to $100,000 may be tax-deductible if the funds are made use of to enhance the property safeguarding the funding. This deduction can cause considerable financial savings for qualified property owners, making equity fundings a tax-efficient means to accessibility funds for home restorations or various other certified expenditures.

In addition, using an equity financing to consolidate high-interest financial debt may likewise cause tax obligation benefits. By settling bank card debt or other financings with greater rates of interest using an equity car loan, homeowners may be able to deduct the passion on the equity lending, potentially conserving even more cash on tax obligations. It's vital for homeowners to seek advice from a tax expert to recognize the certain tax implications of an equity finance based on their individual situations.

Lower Passion Prices

When discovering the financial benefits of equity financings, another crucial facet to take into consideration is the possibility for homeowners to secure lower rate of interest - Equity Loan. Equity financings commonly offer lower rate of interest contrasted to other forms of loaning, such as individual loans or bank card. This is because equity finances are protected by the worth of your home, making them less high-risk for lenders

Reduced rate of interest can result in substantial expense financial savings over the life of the financing. Also a tiny percent distinction in rate of interest prices can convert to significant savings in rate of interest payments. House owners can utilize these savings to settle the lending quicker, develop equity in their homes extra promptly, or buy other locations of their monetary why not try these out profile.

Furthermore, reduced rates of interest can enhance the general affordability of loaning against home equity - Alpine Credits Equity Loans. With minimized interest expenditures, house owners may find it much easier to manage their regular monthly settlements and maintain monetary security. By making the most of reduced interest rates with an equity car loan, home owners can leverage their home's worth better to fulfill their economic goals

Faster Accessibility to Funds

Home owners can speed up the procedure of accessing funds by making use of an equity loan safeguarded by the worth of their home. Unlike various other finance choices that may include lengthy approval procedures, equity financings supply a quicker course to acquiring funds. The equity developed up in a home serves as security, giving lenders greater confidence in expanding credit scores, which improves the authorization procedure.

With equity loans, homeowners can access funds promptly, frequently obtaining the money in a matter of weeks. This quick accessibility to funds can be critical in situations calling for instant financial backing, such as home restorations, medical emergency situations, or financial debt combination. Alpine Credits Equity Loans. By taking advantage of their home's equity, home owners can promptly attend to pushing monetary demands without extended waiting durations typically linked with other kinds of lendings

Furthermore, the streamlined procedure of equity financings converts to quicker disbursement of funds, making it possible for homeowners to seize timely investment chances or handle unexpected expenditures effectively. Generally, the expedited access to funds via equity fundings highlights their functionality and benefit for house owners looking for punctual financial options.

Final Thought

Unlike some various other types of finances that specify how the obtained money needs to be spent, equity financings supply borrowers the autonomy to allocate the funds as needed. One of the key tax advantages of an equity finance is the capacity to subtract the interest paid on the car loan in specific circumstances. In the United States, for instance, rate of interest on home equity lendings up to $100,000 may be tax-deductible if the funds are made use of to enhance the home safeguarding the financing (Home Equity Loans). By paying off credit scores card financial debt or various other fundings with greater passion rates using an equity funding, house owners might be able to subtract the interest on the equity financing, potentially saving even more cash on tax obligations. Unlike various other car loan alternatives that might entail extensive approval procedures, equity fundings offer a quicker course to getting funds

Report this page